A standard part of car insurance in the UK is the Excess, and there are many types including compulsory, driver specific excess, car specific excess, age specific excess, glass excess, and voluntary excess. Excesses are the amount, or amounts, that will be deducted from any payment made in the event of a valid claim against a car insurance policy in the UK. Excesses are generally cumulative, which is to say that in the event of a claim, the total amount withheld from a payment for a claim will be the sum of all applicable Excesses. The insurance company will generally apply the Excesses that it chooses to, while as a customer you can generally choose a voluntary excess – which is designed to lower your premium.

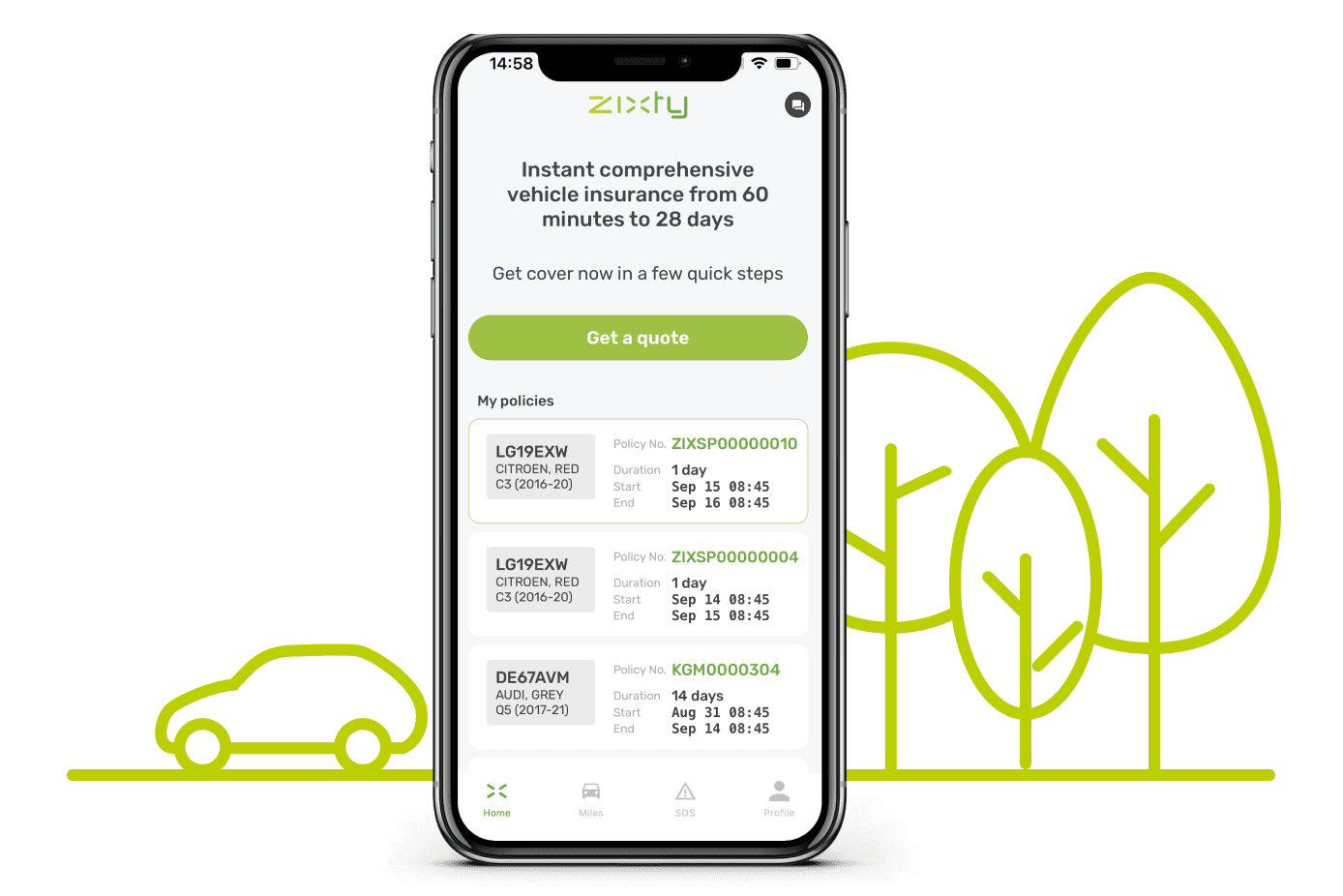

At Zixty we’ve kept it super simple, having just one Excess. If you add Excess Protect to your Zixty temporary car insurance policy then you’re insuring £150 of your excess. So, in the event of a claim against your Zixty short term car insurance policy, you can claim back £150 of your Excess. And, if you add Zixty Miles to your policy alongside Excess Protect we’ll increase your Excess Protect by a further £100.