Adding Excess Protect to your Zixty policy gives you the additional reassurance that in the event of a fault claim, you can claim back £250 of your Excess. That’s the Zixty way.

Reduce your excess

Excesses are part and parcel of car insurance, and if there was a popularity poll, they’re unlikely to fare so well. Add Excess Protect to your policy and bring your Excess down to size.

Standard cover

As standard our Excess Protect add-on provides £250 of cover – allowing you to claim this amount back in the event you have a fault claim.

Zixty Plus

If you choose a Zixty Plus quote, we include £100 of Excess Protection as standard. You can upgrade this to £250 of cover – allowing you to claim this amount back in the event you have a fault claim.

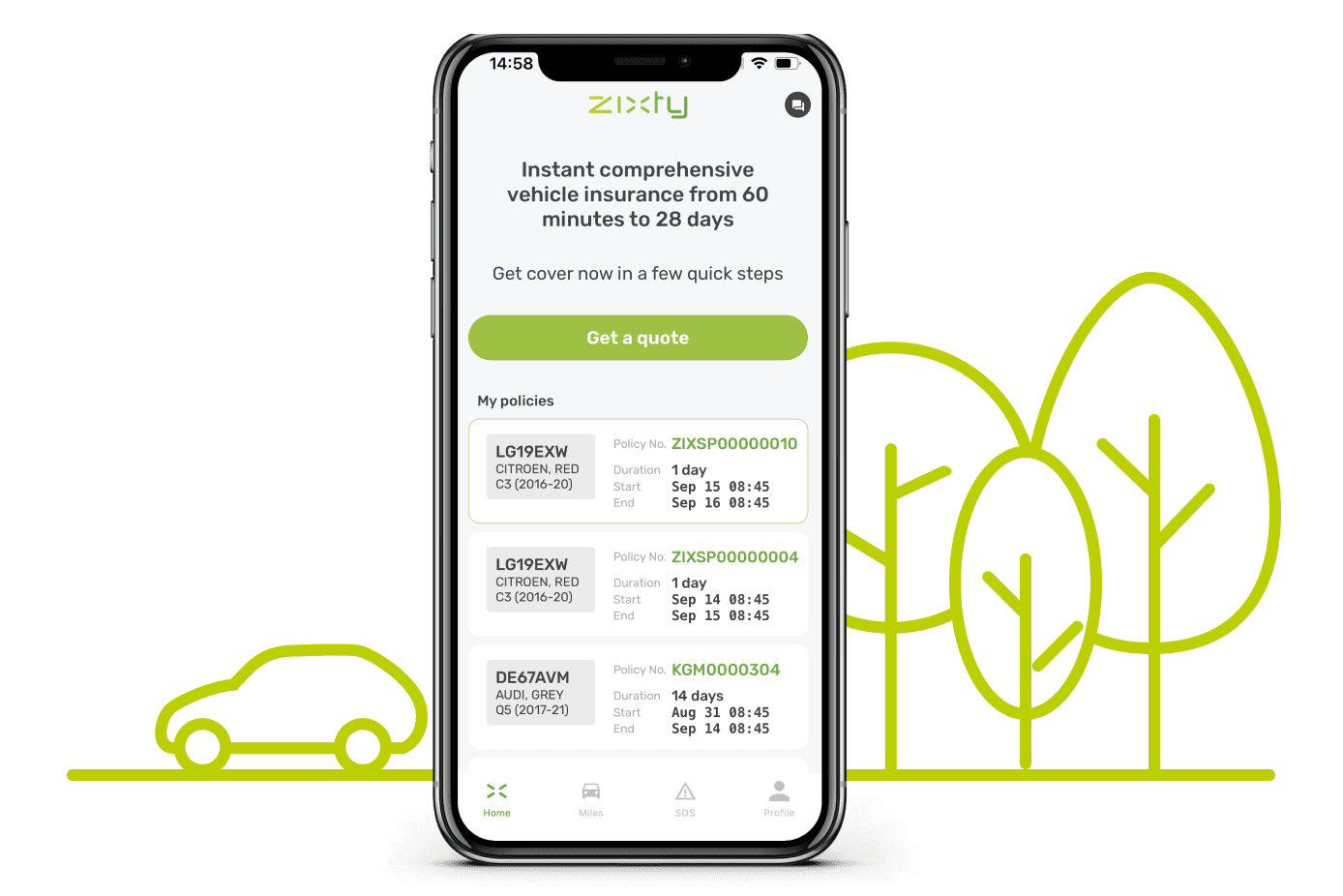

Temporary car insurance that's easy and rewarding

Get a quote

Get a quote

A few quick questions

Done in minutes

Extras

Breakdown Cover

Excess Protect

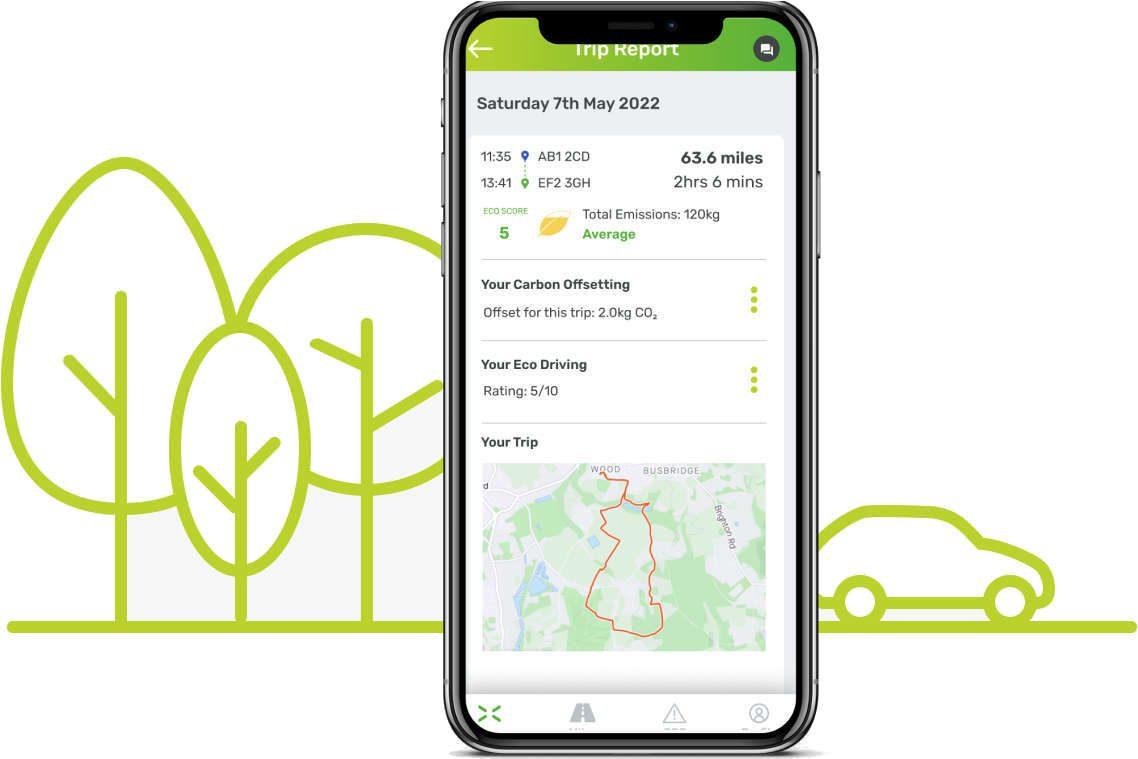

Zixty Miles

Zixty Miles

CO2 offset your policy

CO2 offset your driving

Get tailored driving tips

Feel Good

Offset your CO2

Save fuel

Smile

A trusted provider

Our Excess Protect policy is provided by Universal Insurance. With over 400,000 policies, they’re experts in their field. They work tirelessly to provide the highest level of service possible.

Protecting your pocket

Car accidents and incidents can be a traumatic and inconvenient, and pretty much the last thing you’ll want is more cost. Excess Protect can help bring your Excess right down – so you can enjoy the journey.

What are the benefits of Excess Protect?

In the event of a fault claim against your Zixty short term car insurance policy, your standard Excess will apply. Adding Excess Protect means that you can claim back up to £250 of your Excess.

How does it work?

When you get a Zixty quote you can choose to add Excess Protect for a small extra sum. If you are involved in an accident or incident that is a fault incident, your Excess is payable, but you can then reclaim £250 of your Excess.

Zixty Plus

With a Zixty Plus policy you get £100 of Excess Protect included with your policy as standard, and you can increase this to £250 for a small extra sum. If you are involved in an accident or incident that is a fault incident, your Excess is payable, but you can then reclaim £250 of your Excess.

Key features

- £250 As standard

- 24/ 7 Claims

- Fault Claim

- Fire, Theft & Attempted Theft

- Flood, and Vandalism

- Low cost

- Easy to add

- Trusted provider

Peace of mind cover

- £250 cover : £250 cover as standard

- 24 Claims line : Submit a claim 24/ 7

Love the planet

Add Zixty Miles to your policy for FREE and we’ll offset the CO2 from up to 100 miles of driving each day you’re with us.

Excess Protect guide

What is Excess protection?

Excess Protection is an add-on that you can choose to add to your policy for an extra fee. It reduces the overall excess you will have to pay in the event of a fault claim. You will need to pay your excess to your insurer and then claim back the relevant amount from our Excess Protect partner – Universal Insurance.

How much of my excess does it cover?

We offer a £250 Excess Protect add-on – which is set against the standard Excess.

What incidents are covered?

A Zixty Excess Protect policy is designed to cover Fire, Theft or attempted Theft, Flood, Vandalism, and fault Accidents.

What is an Excess?

An excess is an amount you may have to pay in the event of a claim that is deemed as your fault.

FAQs

Can I add Excess Protect after I’ve bought a policy?

Excess Protect can only be added when you take out your Zixty temporary car insurance policy. It cannot be added later.

What driving locations are covered by Excess Protect?

Zixty Excess Protect covers motor related incidents in the United Kingdom, the Isle of Man, and the Channel Islands.

Can I remove this cover if I change my mind?

You can only remove Excess Protect if your policy has not started. You’ll need to contact us via live chat to make this change. An admin fee may be charged to make this change.

Who is this provided by?

Zixty Excess Protect is provided by Universal Insurance.

Related information and articles

Temporary car insurance

How short term car insurance can save money and supports the sharing economy .

How we carbon offset

How we calculate driving CO2 and our approach to offsetting with Zixty Miles.