Flexible and easy temporary learner driver insurance with cover from 7 days to 24 weeks. Whether you’re learning in your own car, or someone else’s, you can be on the road in minutes.

Learner driver insurance

Learner driver insurance offers easy and flexible short term learner insurance when you’re starting out on your driving journey. Whether you’ve just started learning, or are nearly ready for your test, our insurance offers a simple solution on your car, or one owned by a parent.

Supervision while using learner driver insurance

Until you pass your test, you’re required by law to have a suitably experienced driver in the front passenger seat with you at all times, and they must be in a position to effectively supervise your driving. They must hold a licence that allows them to drive the car that is being used (i.e. if it is a manual car they must hold a manual licence). Our policy requires that the supervising driver must be aged 21 or over, and they must have held their driving licence for 3 years or more.

Learner driver insurance on your own car

If you want to insure your own car while you’re learning, then you’re in the right place. You can take out a Zixty learner driver policy to insure your car from 28 days up to 168 days (24 weeks).

Learner driver on a parent’s car

If you haven’t bought your own car yet, then you can take out a Zixty policy on a car owned and insured by a parent, with duration from 7 days up to 168 days (24 weeks). It is essential that you have the permission of the owner of the car to drive it, and it must already be insured. The good news is that if there is a claim against a Zixty learner driver insurance policy, it will not affect the NCD of the owner.

Learner driver insurance that's quick and easy

Get a quote

Get a quote

A few quick questions

Done in minutes

Extras

Breakdown Cover

Excess Protect

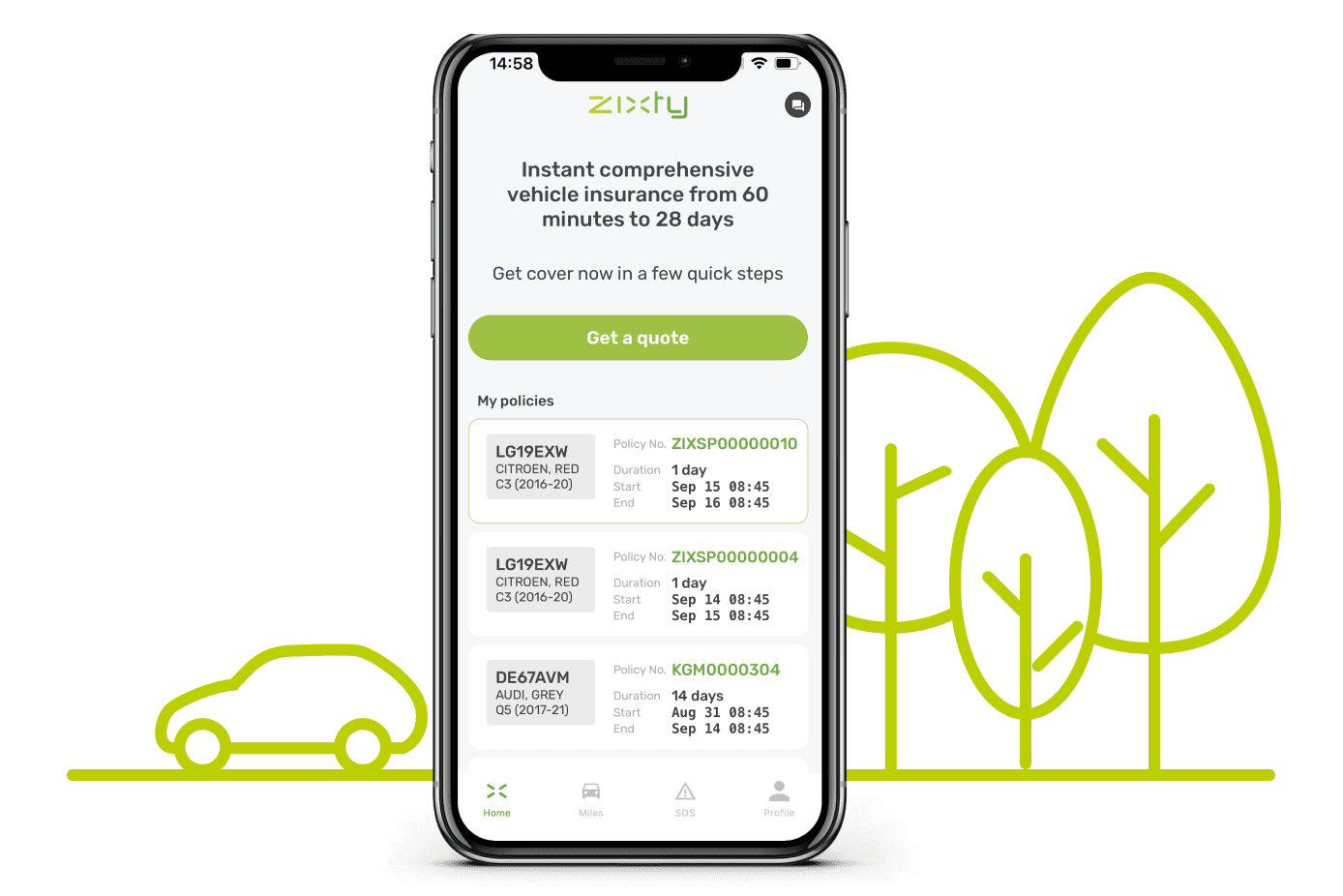

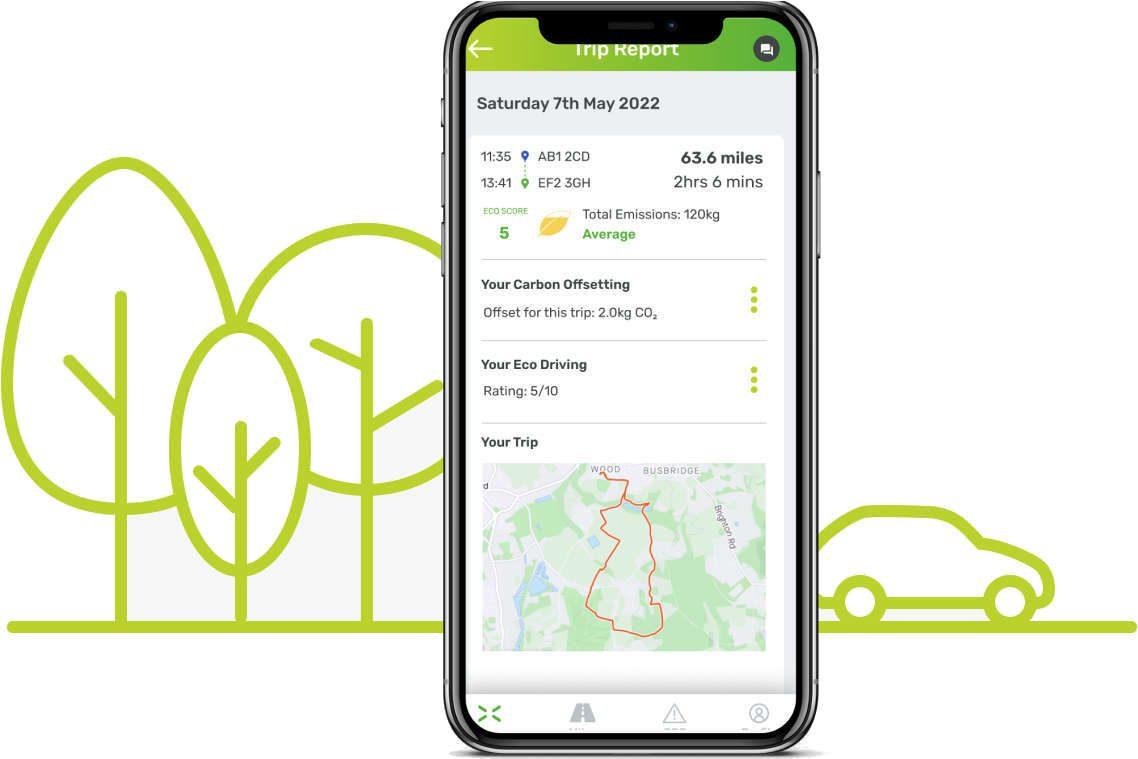

Zixty Miles

Zixty Miles

CO2 offset your policy

CO2 offset your driving

Get tailored driving tips

Get Driving

Practice

Pass

Freedom

Learn with confidence

Our learner driver insurance is backed by trusted insurance names, and as part of the British Insurance Brokers Association, you can be confident that you’re dealing with a legit business. Our insurance activities are also regulated by the Financial Conduct Authority, providing more reassurance that you’re in safe hands.

What we’re about

Times change, and insurance needs to keep pace. Zixty exists to provide learner driver insurance that’s transparent, fair, and most importantly helps people reduce their impact on the environment. By listening to our customers, our future is shaped by your needs.

How does learner driver insurance work?

Our temporary learner driver insurance allows you to practice your driving while holding a provisional driving licence. This isn’t an annual policy, and cover is from 7 days to 168 days (24 weeks) depending on who owns the car that you will be practicing in. If you’re going to be driving your own car, then you simply take out a policy in your own name. If you’re going to be practicing in a car owned by a parent, then you still take out the policy in your name – but you must have their permission to drive the car. The Zixty temporary learner driver insurance policy is in force while you’re driving, and in the event of a claim against the policy while you’re driving, the No Claim Discount (NCD) for the owner’s policy is not affected.

When can I use Zixty temporary learner driver insurance?

The learner driver must be aged 17-21, hold a UK DVLA issued provisional driving licence, and have no endorsements (penalty points) on their licence. They need to be a UK resident (excluding Northern Ireland). Your short term learner driver policy will cease to be valid as soon as you pass your driving test. At this point you must arrange a separate policy, and continuing to drive on a learner driver policy is illegal.

Temporary learner driver insurance with a conscience

Temporary learner driver insurance from Zixty is designed for people who want speed and flexibility from their insurance, but where reducing the environmental impact of driving is important to them. We CO2 offset every policy as standard, and by adding Zixty Miles to your policy for free, we’ll carbon offset up to 100 miles a day while you’re a customer.

Key features

- Comprehensive cover

- Replacement lock/ key cover

- New vehicle replacement*

- Social, Domestic, and Pleasure

- Personal Business Use

- Breakdown & Excess Protect add-ons

- Legal Liability Cover

- Medical Expenses Cover

- Foreign Travel**

Tailor your cover

- Excess Protect : Protect £250 of your excess

- Breakdown cover : Home-start, roadside, and nationwide recovery with our trusted network

- Zixty Miles : Offset the CO2 from up to 100 miles per day for free

Love the planet

Add Zixty Miles to your policy for FREE and we’ll offset the CO2 from up to 100 miles of driving each day you’re with us. By driving really carefully, we may offset even more CO2 than the driving produced – making your journeys carbon negative.

Temporary car insurance guide

What level of cover does temporary learner insurance provide?

Zixty temporary learner driver insurance provides comprehensive cover for Social Domestic and Pleasure purposes as well as for commuting to your normal place of work. Like most short term car insurance policies it doesn’t cover standalone Glass (including windscreens).

Who takes out short term learner insurance if I’m borrowing a car?

The person who is learning and will be borrowing and driving the car needs to take out the policy, and they must have the owner’s permission. If you’re lending a car we’ll advise you via email when the policy has been set up. The borrower will need to know the lender’s email address so that they can receive the policy notification.

Who takes out temporary learner insurance if I’m lending a car?

If you’ve decided to lend your car to a young driver who is learning, then it’s up to them to take out a temporary learner driver insurance policy. They’ll need your permission first, and that’s it. In the unfortunate event of a claim involving your car, your insurance and your No Claim Discount are not affected.

Does temporary car insurance cover business use?

Zixty temporary learner insurance provides you with Comprehensive cover for Social Domestic and Pleasure purposes as well as for commuting to your normal place of work. That said, you must have an appropriately experienced driving with you whenever you are driving. We also cover business use (Class 1) which covers driving to and from other business locations in your normal course of work for your main occupation (please note no delivery or taxi use is covered, and you must be supervised). However, like most short term car insurance policies it doesn’t cover standalone Glass (including windscreens). You need to ensure that the cover meets your needs before buying a policy.

Can I get 1 hour temporary learner driver insurance?

Zixty short term learner driver insurance can cover you from 7 days to 168 days (24 weeks) if you are borrowing a car, and from 28 days to 168 days (24 weeks) if you own the car. These durations should provide enough time for most people to pass their test. Another policy can always be bought if more time is needed.

Do I need to own a car to take out temporary learner driver insurance?

No. You can take out a Zixty short-term learner driver insurance policy on a car you own, or on a car owned by a parent. The owner/ lender of the car will be notified by email that cover has been arranged.

Who can supervise me while I'm learning?

On a Zixty policy the supervising driver must be aged 21 or over, and must have held their licence for 3 years or more. The supervising driver must hold a licence that legally allows them to drive the car (e.g. if it’s a manual car, they must hold a manual licence). They must be in the front passenger seat at all times, must be focussed on the road ahead, and not under the influence of alcohol or drugs that would impair their judgement and driving ability.

Can I learn in a van?

Zixty short term learner driver insurance only covers cars. We don’t cover vans. Sorry.

Temporary car insurance FAQs

Do the vehicle and policy get registered on MID?

We will ensure the vehicle is uploaded to the Motor Insurance Database (MID), and removed when cover ends.

Please be aware that it can take up to 48 hours for MID to be updated – something that’s common to all car insurance companies. If you get stopped by the police, your app holds proof of your insurance.

Does temporary learner driver insurance affect the lender's NCD?

Your Zixty short term learner insurance policy supersedes the lender’s policy while in force. If you need to claim against your Zixty policy, the lender’s No Claim Discount will not be affected.

Does the car need to be insured elsewhere?

If you are learning on a car owned by someone else, the car must be insured by the owner, and it must have a valid MOT.

Can temporary learner driver insurance cover start immediately?

Once you’ve bought your policy it takes just a few minutes to get you on the road (if you want immediate cover). A Zixty policy can start in as little as 5 minutes in the future, and you can choose a start date up to 28 days in advance. Please check your documents for the exact start time of your policy.

Can I drive abroad with learner driver insurance?

Technically, yes. Unless there’s a specific reason to drive abroad as a learner it may not be a brilliant idea. Journeys insured under a Zixty policy must start in the UK. Zixty policies provide the minimum level of cover required by the laws of compulsory insurance for you to use the vehicle on road in any country that is a member of the European Union, and any country that has agreed to follow the European Union directives relating to compulsory motor insurance and is approved by the commission of the European Union. Please refer to your policy wording for full details.

Temporary learner driver insurance help and guides

Breakdown Cover

Zixty Rescue Breakdown cover is designed to get you moving and keep you moving.

Excess Protect

Claim back £250 of your Excess in the event of a fault claim on your Zixty policy.

Zixty Miles

Carbon offset up to 100 miles of driving per day, plus a range of other valuable benefits.